India’s Semiconductor Revolution

How India is transforming into a global semiconductor manufacturing hub by 2030

$18 Billion Investment Commitment

India has committed $18 billion across 10 semiconductor manufacturing projects, representing one of the largest industrial investments in the country’s recent history.

Commercial Production Timeline

India will begin commercial semiconductor manufacturing by the end of 2025, transitioning from a chip importer to a domestic producer.

Market Growth Trajectory

India’s semiconductor market is projected to grow from $38 billion in 2023 to $100-110 billion by 2030, targeting 10% of global consumption.

Manufacturing Infrastructure Scale

10 approved semiconductor projects spanning across 6 states, including fabrication units, assembly facilities, and compound semiconductor production.

Local Sourcing Transformation

Plans to increase local semiconductor sourcing from 9% in 2021 to 17% by 2026 as part of the self-reliance strategy.

Government Incentive Support

₹76,000 crore allocated through Production Linked Incentive scheme, with ₹65,000 crore already committed to approved projects.

India's Semiconductor Revolution Takes Shape with Historic $18 Billion Investment

India has approved an unprecedented ₹1.6 trillion ($18.2 billion) investment across 10 semiconductor projects, marking the country's most ambitious push to become a global chip manufacturing powerhouse.

Breaking Down India's Chip Manufacturing Master Plan

The approved projects span six states and include two major fabrication plants, multiple testing facilities, and packaging units. Tata Electronics leads the charge with its groundbreaking ₹91,000 crore ($11 billion) semiconductor fab in Dholera, Gujarat, developed in partnership with Taiwan's Powerchip Semiconductor Manufacturing Corporation (PSMC).

This facility will manufacture up to 50,000 wafers monthly, focusing on chips for power management, display drivers, microcontrollers, and high-performance computing applications. The fab targets critical markets including artificial intelligence, automotive systems, data storage, and wireless communication.

Additional approved projects include:

- 📌 SiCSem's compound semiconductor facility in Odisha – India's first commercial SiC fab

- 📌 Multiple assembly, testing, marking, and packaging (ATMP) facilities

- 📌 Advanced glass-based packaging units for next-generation applications

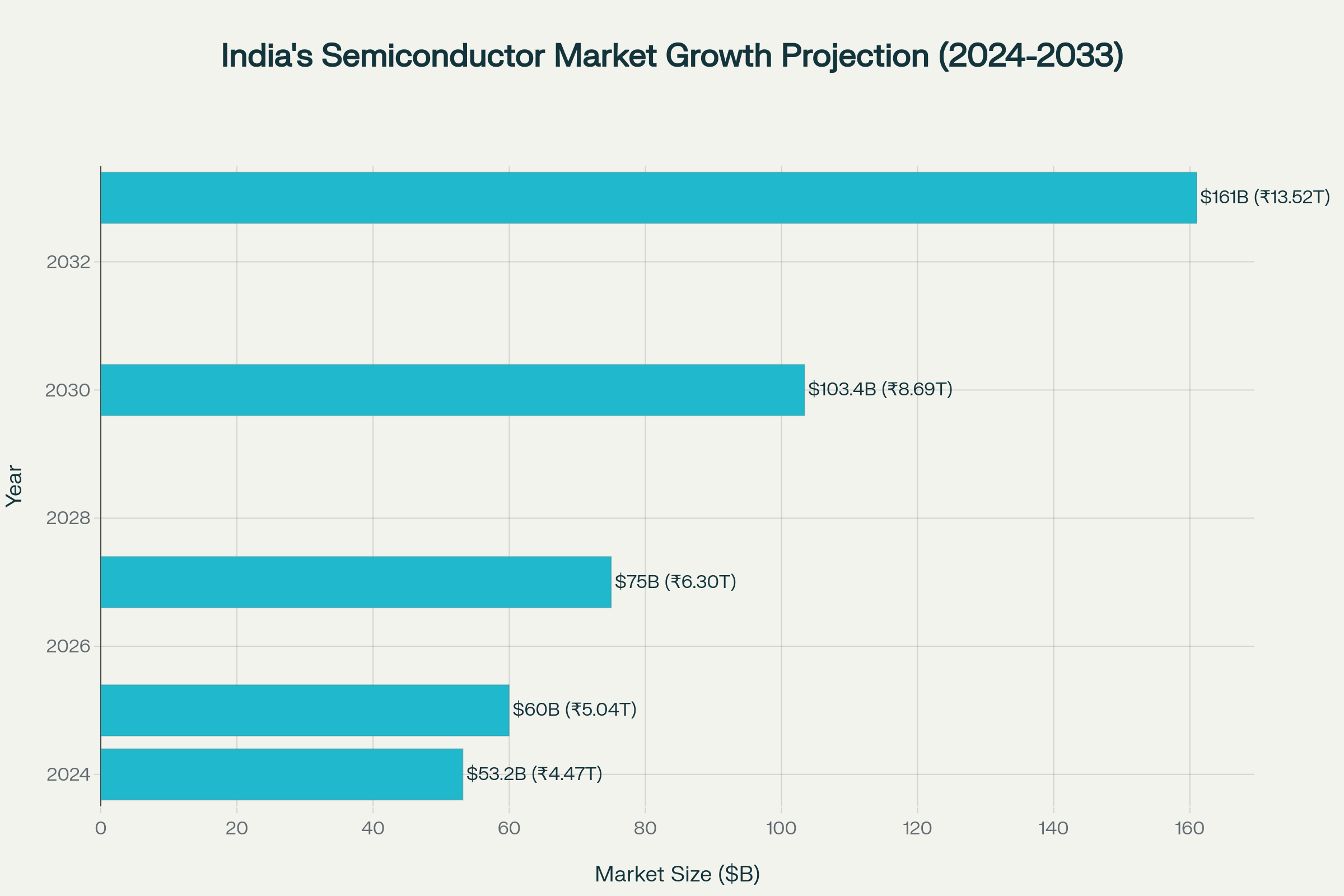

Understanding the Market Opportunity: From $53 Billion to $161 Billion

India's semiconductor consumption market reached $53.2 billion in 2024 and is projected to grow at a robust 13% compound annual growth rate (CAGR) through 2030. The market is expected to reach $103.4 billion (₹8.95 lakh crore) by 2030 and could soar to $161 billion (₹13.52 lakh crore) by 2033.

Key growth drivers include:

✅ Mobile handsets and IT applications (contributing 70% of revenue)

✅ Automotive electronics and electric vehicle adoption

✅ 5G infrastructure and telecommunications expansion

✅ Industrial automation and defense applications

✅ Artificial intelligence and data center requirements

Why India's Timing is Perfect: Global Supply Chain Vulnerabilities

The global semiconductor industry faces unprecedented challenges that create opportunities for India. Taiwan dominates global chip production, with TSMC alone controlling over two-thirds of the contract manufacturing market. This concentration creates significant risks:

⛔️ Geopolitical tensions in the Taiwan Strait threaten supply stability

⛔️ Pandemic disruptions highlighted supply chain fragility

⛔️ Trade wars between major economies affect chip availability

⛔️ Natural disasters can halt production at key facilities

Countries worldwide are investing heavily in semiconductor self-sufficiency. The US CHIPS Act allocated over $450 billion, Europe committed $103 billion, and South Korea plans $470 billion investments through 2047. India's $18 billion investment positions it strategically in this global race.

The Production-Linked Incentive (PLI) Scheme: Making India Attractive

India's government provides up to 50% financial support for semiconductor projects through the PLI scheme, with state governments adding another 20% in incentives. This brings total fiscal support to an impressive 70% of project costs.

Key PLI benefits include:

👉 Capital cost reduction for fabrication plants

👉 R&D investment incentives for technology development

👉 Tax rebates and customs duty exemptions

👉 Fast-track approvals for project implementation

👉 Skill development programs for workforce training

The scheme has already committed ₹629 billion ($7.17 billion) – about 97% of the allocated ₹650 billion budget. This demonstrates strong industry confidence in India's semiconductor potential.

Major Challenges: Infrastructure, Water, and Talent Requirements

Water Consumption Crisis

Semiconductor manufacturing is notoriously water-intensive, with fabrication plants consuming millions of gallons daily. A typical fab requires over 5 million gallons of ultra-pure water daily, necessitating at least 8 million gallons of city water.

India faces significant water stress, with per capita availability of just 1,486 cubic meters annually – expected to decline to 1,228 cubic meters by 2051. This creates substantial challenges for establishing multiple fabs across the country.

Power and Infrastructure Bottlenecks

Semiconductor fabs require uninterrupted power supply and sophisticated infrastructure. India's power supply reliability remains inconsistent in many regions, with recent heatwaves causing industrial disruptions.

Additional infrastructure challenges include:

⛔️ Inadequate transportation networks for specialized equipment

⛔️ Limited availability of ultra-pure chemicals

⛔️ Complex customs procedures for imported materials

⛔️ Need for sophisticated waste management systems

Talent Shortage Reality Check

India faces a projected shortage of 250,000 to 300,000 semiconductor professionals by 2027. While the country houses 20% of global chip design talent, manufacturing requires different specialized skills.

The government has launched initiatives like the "Chips to Startup" program and established Centers of Excellence at premier institutions to address this gap.

Silicon Carbide: The Next-Generation Opportunity

India's first commercial compound semiconductor facility will manufacture Silicon Carbide (SiC) devices in Odisha. SiC represents a significant technological advancement over traditional silicon:

SiC advantages include:

✅ 3x higher thermal conductivity than silicon

✅ 10x higher breakdown voltage capability

✅ Superior high-temperature performance for automotive applications

✅ Enhanced efficiency for power electronics and electric vehicles

The global SiC market is projected to reach $14 billion by 2030, growing at 26% CAGR. Applications span electric vehicles, renewable energy systems, 5G infrastructure, and defense equipment.

Global Players Joining India's Semiconductor Journey

Strategic International Partnerships

Taiwan's Powerchip brings cutting-edge fabrication technology to Tata's Gujarat facility. The partnership includes comprehensive technology transfer, engineering support, and manufacturing expertise.

Micron Technology is establishing a Special Economic Zone in Gujarat with ₹130 billion ($1.51 billion) investment. This facility will focus on memory chip assembly and testing.

ARM Holdings announced plans to design advanced 2nm AI chips from its Bengaluru center, demonstrating confidence in India's design capabilities.

Building the Complete Ecosystem

India's strategy extends beyond manufacturing to create a comprehensive semiconductor ecosystem:

📌 Design capabilities through government infrastructure support to 278 academic institutions

📌 Testing and packaging facilities across multiple states

📌 Supply chain integration with local ancillary unit development

📌 Workforce development through specialized training programs

Economic Impact: Jobs, Growth, and Self-Reliance

The approved projects are expected to generate over 20,000 direct skilled jobs and create numerous indirect employment opportunities. The semiconductor industry's high-tech nature means these positions offer significantly higher wages than traditional manufacturing.

Economic benefits include:

➡️ Reduced import dependence – India currently imports 100% of its semiconductor needs

➡️ Foreign exchange savings worth billions annually

➡️ Technology transfer and indigenous innovation capabilities

➡️ Strengthened electronics ecosystem supporting multiple industries

Timeline: When Will "Made in India" Chips Hit the Market?

Key milestones:

- End of 2025: First commercial semiconductor production begins

- 2026: Tata's Gujarat fab commences full-scale operations

- 2027-2028: Additional fabs become operational

- 2030: Target to achieve $100-110 billion market size

Prime Minister Modi announced that India's first domestically produced semiconductor chip will reach markets by the end of 2025, using 28-90 nanometer technology.

Realistic Assessment: Challenges vs. Opportunities

What Could Go Right

India's semiconductor ambitions benefit from several favorable factors:

✅ Strong government commitment with substantial financial backing

✅ Large domestic market providing immediate demand

✅ Existing IT talent pool that can be retrained for semiconductor roles

✅ Strategic geopolitical positioning as supply chain diversification accelerates

Potential Roadblocks

Industry experts remain cautiously optimistic. Stephen Ezell from the Information Technology and Innovation Foundation notes that "India needs more than a few fabs – it needs a dynamic, deep, and long-term ecosystem."

Critical success factors include:

⛔️ Sustained infrastructure development beyond initial investments

⛔️ Continuous technology partnerships with global leaders

⛔️ Long-term policy stability beyond current incentive schemes

⛔️ Environmental sustainability solutions for water and energy consumption

Learning from Global Success Stories

Taiwan's semiconductor dominance didn't happen overnight – it required decades of sustained investment, technology partnerships, and ecosystem development. South Korea's memory chip leadership similarly evolved through consistent government support and industry collaboration.

India's advantage lies in learning from these experiences while leveraging its unique strengths: a massive domestic market, abundant technical talent, and strategic timing as global supply chains diversify.

The Road Ahead: Building India's Silicon Valley

India's $18 billion semiconductor investment represents more than financial commitment – it's a strategic vision for technological self-reliance. Success will require addressing infrastructure challenges, developing specialized talent, and maintaining long-term policy support.

The next 3-4 years will be crucial in determining whether India can transition from electronics consumer to semiconductor producer. With proper execution, this investment could position India as a major player in the global chip industry, reducing dependence on foreign suppliers while creating high-value domestic employment.

The semiconductor revolution is just beginning, and India's bold $18 billion bet could reshape not just its own technology landscape, but influence global supply chains for decades to come.